LAND AUCTION

803.24+/- Surveyed acres of well located Altamont Township, Deuel County, SD Land – Inclusive of a mixture of cropland, CRP & pasture

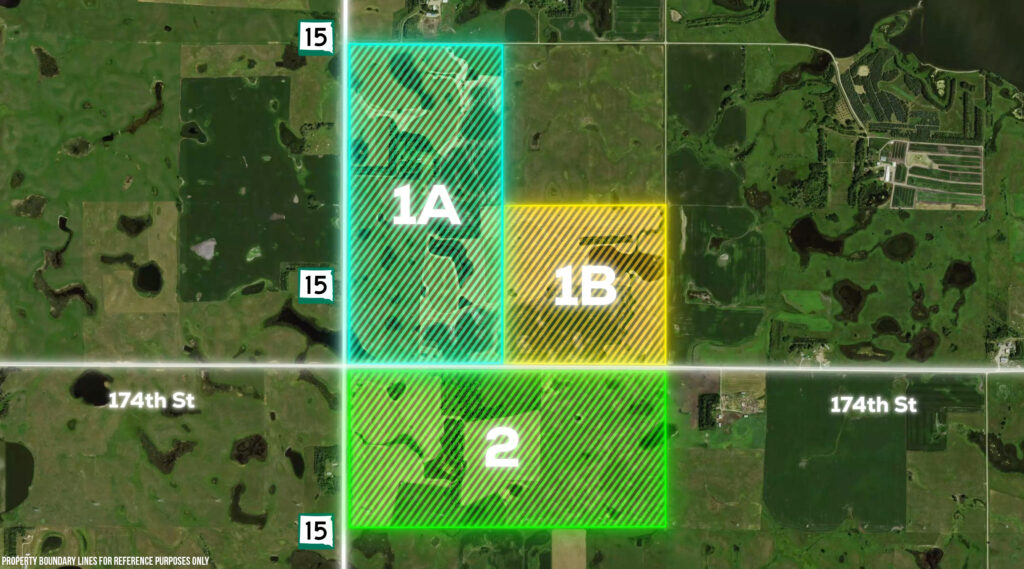

These +/- 803.24 Surveyed Acres will be Offered as – FARM #1 – +/-481.16 Surveyed Acres with Remnants of a Former Farmstead with a Well (Not in Use) with a Mixture of Cropland, Pasture & Areas with Some Hunting & Wildlife Habitat – To be Offered as PARCEL #1A (The W ½ of Sec. 11) – +/-320.41 Acres w/Remnants of a Farmstead, Cropland, CRP & Pasture; PARCEL #1B – (The SE ¼ of Sec. 11) – +/-160.75 Acres of Cropland & Pasture or as Parcels #1A & 1B Combined – +/-481.16 Acres – Both Located in Sec. 11; and FARM #2- +/-322.08 Surveyed Acres in Sec. 14; or as FARMS #1 & #2 Combined – The Entire +/- 803.24 Surveyed Acres – Which is a Combination of Both Farms #1 & #2 in Their Entirety.

FARM #1: +/-481.16 Surveyed Acres – Legal Desc.: Parcel #1A – +/-320.41 Acres – The W ½ of Sec. 11, T. 116N., R. 49W.; Parcel 1B – 160.75 Acres – The SE ¼ of Sec. 11, T. 116N., R. 49W.; all in Altamont Twp., Deuel County, SD.

FARM #1 will be offered as PARCEL #1A – The W½ of Sec. 11 comprised of +/-320.41 Surveyed Acres; PARCEL #1B – The SE¼ comprised of +/-160.75 Surveyed Acres; or as PARCELS #1A & #1B Combined – The +/-481.16 Surveyed Acres as a Unit. Parcel #1A is a +/-320.41 Acre Surveyed Parcel in the W½ of Sec. 11 which includes remnants of a former farmstead being inclusive of a barn, a well that is presently not in use, trees and other incidental improvements, along with a mixture of cropland, CRP and pasture; Parcel 1B is a +/-160.75 Acre Surveyed Parcel in the SE¼ of Sec. 11 and is comprised of a mixture of cropland and pasture/hayland. According to FSA information FARM #1 as a whole is identified as Tract #610 and is indicated to have approximately 190.16 acres considered as cropland, of which approx. 69.04 acres is enrolled in CRP (all of the CRP being in the W½ of Sec. 11 or Parcel #1A), leaving approx. 121.12 acres of effective cropland subsequent to the reduction of the CRP acres, with a 51.50 acre corn base with a 149 bu. PLC yield, a 40.96 acre wheat base with a 58 bu. PLC yield, a 12.60 acre soybean base with a 42 bu. PLC yield, a 5.60 acre barley base with a 39 bu. PLC yield and a 4.70 acre oats base with a 51 bu. PLC yield. The CRP is currently under 2 contracts – Contract #11262B has 63.24 acres enrolled at $130.28 per acres generating a total annual payment of $8,239.00 and is scheduled to expire on 9/30/2034; Contract #11422A has 5.80 acres enrolled at $189.21 per acre generating a total annual payment of $1,097.00 and is scheduled to expire on 9/30/2031. This farm either as individual parcels or as a whole is extremely well suited for us in conjunction with a diversified row crop and cattle operation, furthermore with the existing CRP acres, trees and other attributes Parcel #1A affords some excellent hunting opportunities. This property is subject to a combination of US Fish & Wildlife Wetland Easements, with the S½ of Section 11 being subject to a Wetland Easement – which allows for row cropping or grazing at any time, although prohibiting filling, burning or draining of any of the designated wetland areas; In addition there are two areas containing a total of 190 acres that are also subject to a perpetual US Fish & Wildlife Grassland Easement – these areas include approx. 90 acres including the W½ SW¼ (+/-80 Acres) and the adjacent area lying directly north in the S½ S½ SW¼ NW¼ (+/-10 Acres), as well as an additional 100 acres in the N½ SE¼ and the E½ SE¼ SE¼. According to a review of the FSA aerial map it appears that Fields #17 and #18 together consist of approx. 230 acres of pasture. Livestock water in the pasture is provided by a combination of stock dams/dugouts, ponds and seasonal waterways. Rural Water is located on the W. side of Hwy. #15 & the N. side of 173rd St. According to information obtained from Surety Agri Data, Inc. – FARM #1 as a whole has a soil index of 62.8; while individually Parcel #1A has a soil rating of 64.3 and Parcel 1B has a soil rating of 59.8. This land has topography which is generally gently rolling. There also is an existing Wind Easement on the property with Southern Power Company on +/-478 acres in Sec. 11 which currently is paying approx. $15.00 per acre which will be prorated in accordance with calculations as determined by Southern Power and Debra Fromm of the Fromm Family and thereafter assigned and a succession agreement executed between Southern Power and the buyer. The 2024 RE Taxes payable in 2025 on this property on Parcel #1A (W ½ of 11-116-49) are $3,894.62 and on Parcel #1B (SE ¼ 11-116-49) are $1,693.94.

FARM #2 – +/-322.08 Surveyed Acres of Hayland & Pasture – Legal Desc.: The N½ of Sec. 14, T. 116N., R. 49W., (Altamont Twp.), Deuel County, SD. – With the Northwest Corner of FARM #2 located from the Jct. of SD Hwy #15/476th Ave. and 174th St. – approx. 1 mile north of Altamont, SD.

FARM #2 is an excellent parcel of East River SD pasture/hayland, that is especially well suited for the cow-calf producer. This parcel appears to have a combination of native and tame grass, with water provided by a combination of stock dams/dugouts, ponds and seasonal waterways. There is an existing Brookings-Deuel RWS Rural Water Line which runs across the West side of Farm #2. Within this parcel, the FSA aerial photo shows 5 fields that at some point may have been utilized as cropland, although none of this land can be row cropped as the entire property is under a combination of perpetual US Fish & Wildlife Grassland and Wetland Easements and as such is essentially permanent pasture with row cropping of any portion prohibited. The perpetual grassland easement prohibits tillage on the land, but allows unrestricted grazing and haying after July 15th in accordance with the term of the easement. According to information obtained from Surety Agri Data, Inc. – FARM #2 has a soil rating of 57.1. This land has topography which is generally gently rolling to rolling. There are no wind easements in place on this property. In addition to the pasture and grazing opportunities, this parcel may have some added hunting prospects. The 2024 RE Taxes payable in 2025 on this property (N ½ 14-116-49) are $3,259.16.

Deuel County, SD

Deuel County, SD